Want to file your BingX Crypto taxes in the USA? This should be a helpful guide for you.

Filing your Crypto taxes is one of the challenging tasks in the USA, especially when IRS asks you to follow cost basis method to file your taxes. A cost basis method is when you have to consider the equivalent amount in USD when you trade your BingX or other cryptocurrencies. The challenge is when you have hundreds and thousands of such historical trades for the tax season, and you need more time to calculate your taxes.

This is when CoinLedger makes it easier to file your BingX Crypto taxes. It lets you import your data, classify it into ordinary and capital income, and use tax software integrations to file your taxes.

BingX partnered with CoinTracking, which also offers a tax platform, but for this guide, we will stick with CoinLedger and, in detail, discuss how to file your BingX taxes and fill in the IRS Form 8949 for the tax season.

But first, what is CoinLedger?

What is CoinLedger: The Crypto Tax Software You Need

CoinLedger is a Crypto tax software that makes it easier to file your Crypto taxes and classify them into ordinary or capital income. The rewards, staking, interests, AirDrops, and likewise Crypto that you earn are considered ordinary income and have to be filed under the ordinary tax income bracket. All the other trade, buying, and selling of Crypto are considered capital income with capital gains or losses.

CoinLedger makes it easier for you to classify your transactions. Also, you can import multiple wallets, exchanges, DeFi, and NFTs to calculate and file all your Crypto taxes in a single go. Once the tax reports are ready, you can file them then and there with the tax software integrations in CoinLedger, like TurboTax or TaxAct.

CoinLedger Crypto Tax Software

- Summary and reports on your Crypto capital gains and losses

- Add or link unlimited exchanges and wallets to your CoinLedger account

- Import all kinds of crypto transactions, including Blockchain, DeFi, NFTs, and more

- Classify ordinary Crypto income (rewards, gifts, and more) and Crypto trade into separate entities

- Import data using API auto-sync, public wallet address, and CSV files

- Generate IRS Form 8949 with your tax reports

- Integrate tax software to quickly file your Crypto taxes as per the norms

How to File Your BingX Taxes in the USA using CoinLedger Tax Software

BingX is a popular Crypto exchange platform that allows you to trade with 600+ cryptocurrencies. And if you are reading this guide, likely, you are actively using this wallet for Crypto trading. But what about taxes? The IRS announces cryptocurrencies as properties and should be taxed accordingly. This is where CoinLedger comes into the picture, and here is how you can file your BingX taxes in the USA using this handy Crypto tax software.

Step 0: Creating your CoinLedger Account

The first and foremost step is to create a CoinLedger account. If you already have an account, you can skip this step, and for everyone else, here is how you can easily create your CoinLedger account.

- Visit the CoinLedger website and tap on the “Sign up” button from the top right of your screen.

- Here, you will find a couple of options to create your CoinLedger account, for instance, an email id and password, signing up with Google, and signing up with your CoinBase wallet.

- Once your account is successfully created, you can see an option to choose the country you live in, timezone, and currency. After setting up your preferences, you can tap on the “Continue” button.

- When you create your CoinLedger account, you get to add your wallets and exchanges then and there, but you can always skip this step and add them later.

- In the next step, you can find your CoinLedger dashboard and start connecting your Crypto wallets and exchanges.

Step 1: Connecting BingX Exchange to CoinLedger

After creating your account or logging in to your CoinLedger dashboard, our next step to file our BingX taxes is to first connect our account. Now, CoinLedger allows you to connect wallets and exchanges in different ways, but for this guide, we are going to use a downloadable CSV file from our BingX account.

Here is how to connect BingX Exchange to CoinLedger,

- Login to your CoinLedger account, and click on the “Add Account” button from the dashboard.

- You can now see an entire grid of supported wallets, exchanges, DeFi, NFTs, and more.

- Either by using the search option or scrolling the grid, look for the “BingX” exchange icon and tap on it.

- Once you tap on it, you can find the BingX exchange is now added to your dashboard.

Step 2: Mapping your BingX Trades

Once you have BingX added to your dashboard, the next thing to do is import the transactions file so we can go ahead with calculating the taxes with CoinLedger. Since BingX is an exchange, we will need to upload the CSV file to the dashboard and ensure that it matches the template that CoinLedger offers.

Here is how to go ahead with mapping your BingX trades for taxes,

- Tap on the “BingX” icon from the left of your dashboard, and you can find a dedicated screen on the right to upload your trades.

- Here, you can find an option to download the universal CSV template, which our CSV file needs to follow. The whole reason to have a universal template is to ensure all the transactions are properly read by the tool and calculated accordingly. So, go ahead and download the universal CSV template.

- Head to BingX and log in using your account, then under the Self-Service Section of the help center, tap on the “Help” option.

- You should now be able to find the option to “Export Statements/Orders,” tap on it.

- Now, choose the date range and filters, and then tap on the “Generate” button.

- BingX will now generate an Excel sheet for you which you need to download.

Once you have the historical transaction statement from the Excel sheet, the next thing to do is start adjusting the entries as per the universal CSV template and then save the file.

Note: BingX only allows you to generate up to five transaction history statements and five order statements every month. And in certain regions, the data can only be exported for the past 30 days.

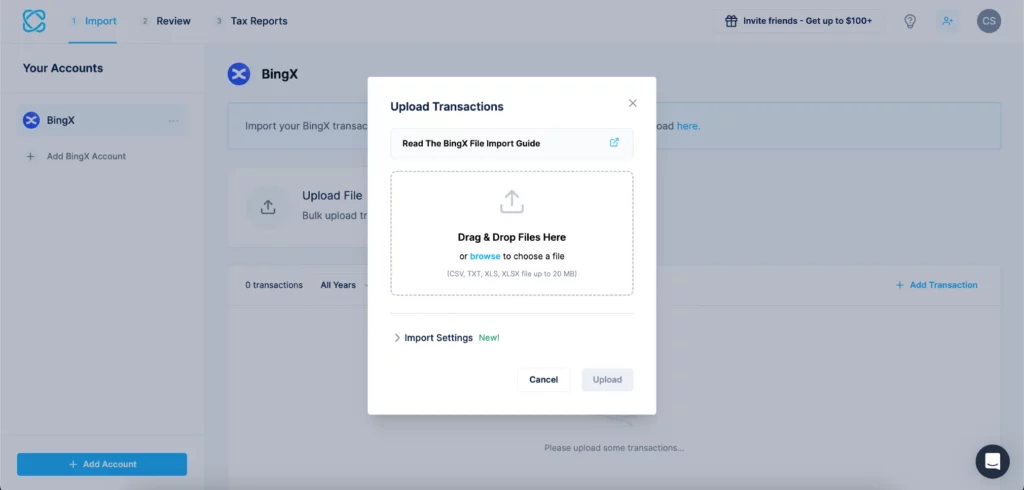

Step 3: Uploading your BingX Statement to CoinLedger

Ensure you have saved the changes to the file and the extension is unchanged. We still want the file to be in Excel or CSV format.

The next step is to upload your file to the CoinLedger account and start reviewing the transactions,

- On your CoinLedger dashboard, select the BingX account we priorly added.

- You can now find an option to upload your CSV file to the dashboard; tap on it.

- Now, a small window allows you to browse your computer and upload the CSV file, or you can even drag and drop the file to upload it.

- Once you upload, it should take a few seconds for the data to be processed.

- Since you have already classified the transactions as per the universal template, no additional classification is required, but if you are unsure or missed out on a transaction, you can add the transaction and classify it in the review section.

Step 4: Generating the Tax Reports and Uploading it to Tax Software

Navigating to the “Tax Reports” tab should show a complete summary of tax gains and losses on your BingX account. You can even go back and add all your other wallets and exchanges before submitting your Crypto taxes to the tax software. However, if you only use BingX, you can go ahead and submit your tax.

One of the best things about CoinLedger is you can also invite your tax professional to review your transactions before you actually submit them. All it takes is their email id, and they will be invited to view and download your BingX tax reports. The alternate option is to do it yourself by using the integrated tax platform of your choice.

But first, since we are filing our BingX taxes in the USA, we will fill out the IRS Form 8949 using our tax reports. Here is how to do it,

- Head to the “Tax Reports” tab, and from the right of your screen, you will find the section “Tax Reports Download,” select “IRS Forms” from the available options.

- Now, you will here find a bunch of options with IRS Forms, pick the one suitable for you, for instance, IRS Form 8949, and CoinLedger will fill in all the gains and losses for you.

- From the “Tax Reports” screen, you can then select the preferred Tax software and send these transactions directly to them. For instance, with TurboTax Online, you can E-file your BingX taxes, or when you pick TurboTax Desktop, you can club your BingX tax report with your other taxes.

- If your tax software is not listed in the options, you can even download the CSV version of your tax reports and then use it separately on your preferred software.

Frequently Asked Questions [FAQs] on BingX Taxes with CoinLedger

To generate tax reports for BingX taxes using CoinLedger, go to the “Tax Reports” tab on your dashboard. From the “Tax Reports Download” section, select the appropriate IRS Form, such as Form 8949. CoinLedger will fill in all the gains and losses for you based on your transactions. You can then send these reports directly to your preferred tax software or download them as CSV files.

To upload your BingX transaction statement to CoinLedger, go to your CoinLedger dashboard, select the BingX account you added, and click on the option to upload your CSV file. You can browse your computer and upload the file or simply drag and drop it. The data will be processed, and you can review the transactions.

Yes, you can import your BingX transaction history to CoinLedger. BingX allows you to export transaction history statements as an Excel or CSV file. CoinLedger provides a universal CSV template that your BingX transaction data should follow for proper processing.

To connect BingX Exchange to CoinLedger, log in to your CoinLedger account, go to the dashboard, and click on the “Add Account” button. Look for the “BingX” exchange icon in the supported wallets and exchanges list and click on it to add it to your dashboard.

Wrapping up: BingX Taxes with CoinLedger Made Easy

This winds up our simple guide on how to do your BingX taxes with CoinLedger with detailed steps. If you are facing issues with importing BingX transactions, you can get in touch with the CoinLedger team; they are supportive and come up with quick resolutions. Also, there are other tax software, such as Cointracking, that help you with easy filing of your Crypto taxes. We find CoinLedger easier, and it also comes with a free plan, so it is a good shot to check it out.