Want to know if CoinLedger is the best Crypto Tax software for you? Here is my detailed CoinLedger Review.

If you are into Crypto, you will likely jump between different types of coins or exchanges to book a good or the best profit. But did you know every time you make this exchange, deposit, or withdraw your cryptocurrency, you will have to pay taxes to the IRS?

Now, for those who are active crypto traders or someone who just stepped into cryptocurrency, filing taxes can be a bigger challenge.

This is because you will have to consider the time of trade, convert your purchase into the equivalent of US dollars,, and then add it to your tax file. If you are buying a cryptocurrency with US dollars, it is fairly easy to make it a note, given there are only a bunch of transactions. But if you are buying cryptocurrency using another cryptocurrency or there are a lot of transactions in your active trade, you need something that can make the taxation easy and save your hours together.

Here it is: CoinLedger (formerly known as CryptoTrader Tax).

CoinLedger Overview

- Summary and reports on your Crypto capital gains and losses

- Add or link unlimited exchanges and wallets to your CoinLedger account

- Import all kinds of crypto transactions, including Blockchain, DeFi, NFTs, and more

- Classify ordinary Crypto income (rewards, gifts, and more) and Crypto trade into separate entities

- Import data using API auto-sync, public wallet address, and CSV files

- Generate IRS Form 8949 with your tax reports

- Integrate tax software to quickly file your Crypto taxes as per the norms

| Feature | Details |

|---|---|

| Ease of Use | Intuitive interface designed for both beginners and seasoned crypto traders. |

| Integrations | Supports unlimited exchanges, wallets, DeFi protocols, and NFT platforms with API sync or CSV upload. |

| Tax Reporting | Generates IRS Form 8949, capital gains, income reports, and audit trails for complete compliance. |

| Transaction Support | Handles blockchain transactions, DeFi staking, NFT trades, and ordinary income classifications. |

| Portfolio Tracking | Offers a dedicated portfolio dashboard for gains, losses, and asset performance tracking. |

| Accuracy | Provides error detection and manual classification for precise tax reporting. |

| Data Import Options | Supports API sync, CSV uploads, and public wallet address linking for flexible data imports. |

| Security | Ensures data safety with read-only APIs, encryption, and no private key access. |

| Pricing | Affordable plans starting at $49/year with flexible options based on transaction volumes. |

| Customer Support | Provides email support and a detailed help center with guides for common issues. |

Overall Rating:

CoinLedger Review: It is one of the best Crypto tax tools I have come across and offers great value-added features for those who want to save a lot of their time doing tax calculations. All it takes is linking your wallets and exchanges, reviewing your transactions, and generating your Crypto tax reports. What I love the most is it also pre-fills the IRS Form 8949 for you and integrates multiple tax software to make it an easy process.

Overall, the tool is perfect for those who want to avoid spending their hours doing complex tax calculations and rather focus more on the trade. The best part is you now have a free account option to learn how the tool works and pay only during tax season to generate your reports. I love this platform and give it a big thumbs up.

Pros

Cons

This information is for educational purposes only and should not be considered financial advice. Affiliate product listed below but with unbiased and uninfluenced review. Read Affiliate Disclosure.

Crypto Tax Basics

IRS, in recent years, termed cryptocurrency as securities (like stocks and bonds). These include all the crypto tokens, including the NFTs (The pictures, music, and other art stuff you have been buying). And if you own a cryptocurrency, at some point in time, you are going to file it for taxes.

Likewise, with most financial tools, you don’t have to pay tax if the Crypto is just resting in your wallet. When you make a transaction with it, maybe exchange it with another coin, send it to another wallet, or trade it, the tax is implied.

Here, as per the IRS, we need to use a cost basis on cryptocurrencies, and the equivalent value of the trade is considered for capital gains or losses. If you have earned cryptocurrency through other means, such as a reward or mining, it is considered as an ordinary income and taxed accordingly.

Understanding Capital Gains and Losses in Crypto Taxes

Capital Gains and Losses are simple concepts, and they are likewise to profits and losses when you make a trade with cryptocurrencies. When you sell, trade, or dispose of your crypto holdings, the difference between the acquisition cost (purchase price) and the selling price results in either a capital gain or a capital loss.

Here is how capital gains and losses in Crypto typically work,

Capital Gain: If the selling price of your cryptocurrency is higher than the price of purchase in the past, you have a capital gain. Now, here, we have both short-term gains and long-term gains, which are taxed accordingly and as per the law of the residing country.

Holding Period: The time during which the cryptocurrency rests in your wallet before selling or trading it off. In most countries, if you are holding cryptocurrency for a favorable long period, say one year, you are eligible for preferential taxes, known as long-term gains. The benefit is that the tax bracket on long-term gains is less than that for short-term gains.

Capital Losses: If the selling price of your cryptocurrency is lower than the price of purchase in the past, you have a capital loss. Capital losses can sometimes be used to offset capital gains in the same tax year, reducing your overall tax liability.

Wash Sales: Some jurisdictions have rules against the concept of “Wash Sales” that consumers use to trick the law. This essentially means you cannot claim a capital loss for selling or trading your cryptocurrency and purchasing it immediately after.

What is CoinLedger: Filing Crypto Taxes Made Easier

Now that we know most of the basics of crypto taxes and how you need to file taxes on a cost basis, It is still a tedious task. Imagine yourself spending your weeks looking at the historical data and converting all your transactions so you can correctly file your taxes.

That’s a hell of a lot of time and too much work to do.

This is where CryptoTrader Tax, now known as CoinLedger, comes into the picture.

CoinLedger is a platform that makes your tax calculations for cryptocurrency easier. The tool lets you connect your wallet using an API service and import all your transactions. It then looks into the historical data and, using acceptable practices, calculates the tax for you. You can always edit your transactions or add newer transactions from other wallets and Crypto earned from other sources.

But that’s not where you need to stop. There is more to the tool.

It also lets you generate a Form 8949 and integrates other tools like TurboTax and TaxAct to file your taxes then and there with an E-filing feature. So you don’t have to do the entire process manually and keep your focus on trading your cryptocurrencies rather than spending your essential time on making calculations.

If you have a lot of selling and trading, this software should help you save a lot of hours. Here are the features that make it one of the best.

CoinLedger Features

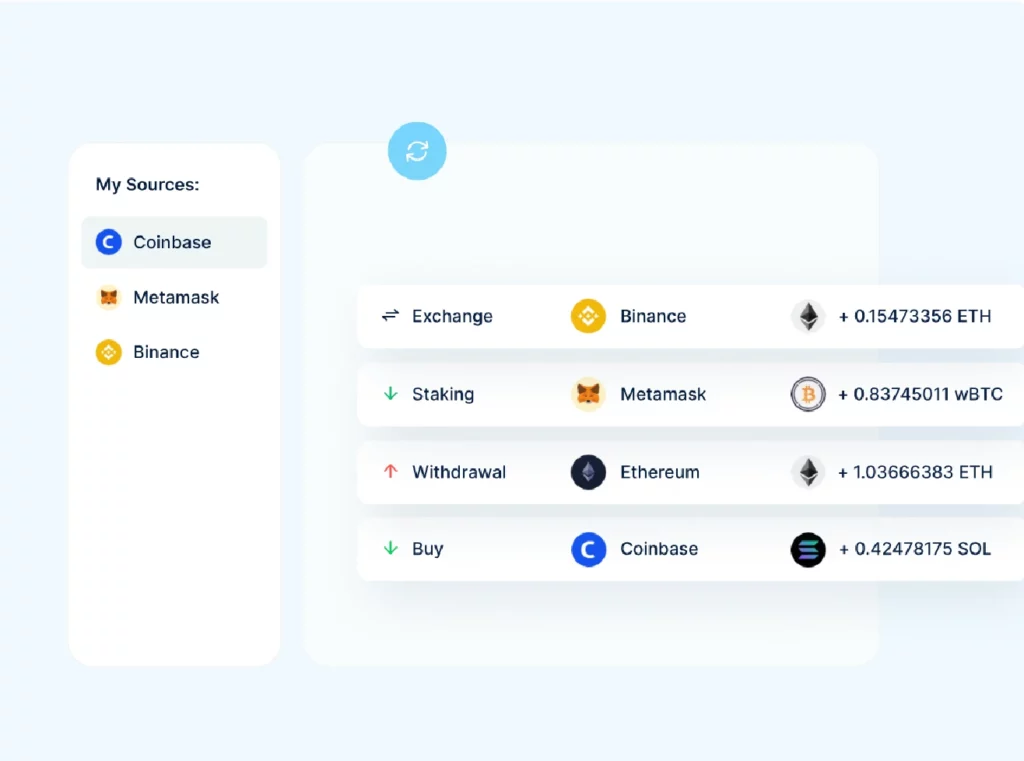

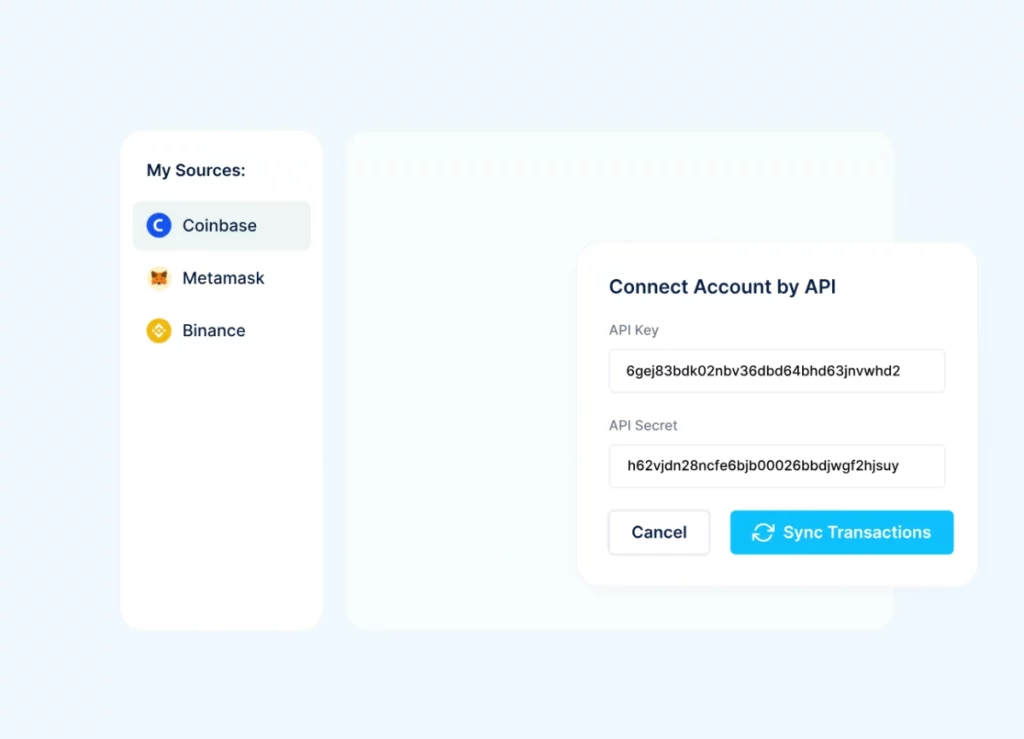

One of the best things about CoinLedger is that it lets you import your transactions from the most popular wallets and supports a wide set of exchanges. Since the import is based on API, you save a lot of time when manually entering these entries.

Most users settle for this one feature, but CoinLedger has a lot of other features.

Let’s discuss each of these features in detail to make it handy for you to make a decision.

1. Core Features of Coin Ledger

The main objective of this tool is to make your crypto taxation an easy process, and the core features are designed around it. For instance, you can import your crypto transactions, track portfolios, track NFT transactions, and reconcile errors.

You can import almost 20,000+ different kinds of cryptocurrencies, which covers the popular ones and also most of the well-known ones around the globe. Since CoinLedger helps you tax crypto transactions globally, it has become one of the most crucial factors in using this tool.

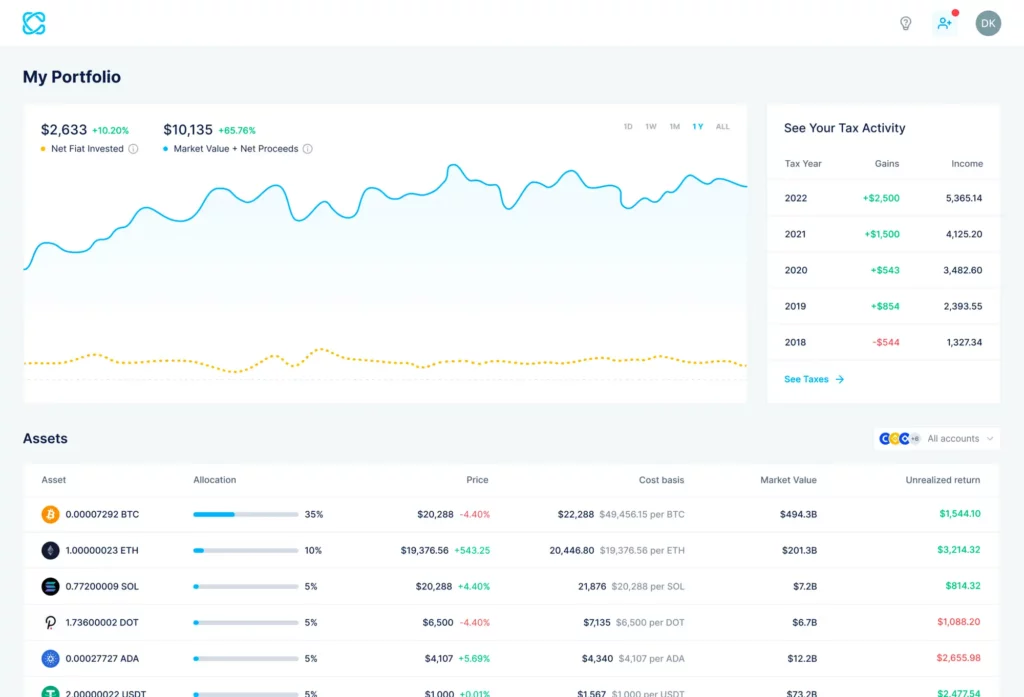

Well, if you have been trading crypto for a while, you can also track your portfolio with gains and loss history on your platforms for free. So, basically, you don’t have to keep checking on multiple wallets to see your portfolio; you can get it all here at CoinLedger when you link them.

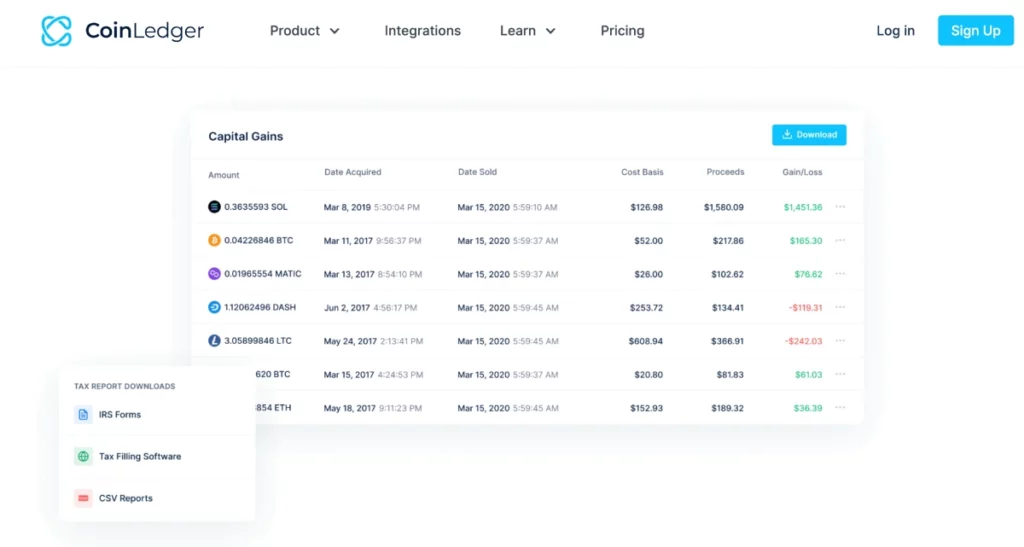

Mentioning wallets, you can add or link unlimited exchanges and wallets to your CoinLedger account, even with the free plan. So, with this tool, you don’t have to calculate taxes individually on each wallet and create confusion while filing your taxes; it would also be a time-consuming process otherwise. Calculating gains on all the platforms would be more complex, which is also why I like CoinLedger, as it offers an overview of capital gains from all the platforms right on your screen.

You can import all kinds of crypto transactions, including those involving blockchain and DeFi protocols, or even NFTs, and recalculate your reports as many times as you wish without any additional cost, which is a more consumer-centric and friendly treat. Also, if there is missing data in your report, you can just add your data and recalculate the taxes before your e-filing.

2. Included Tax Reports

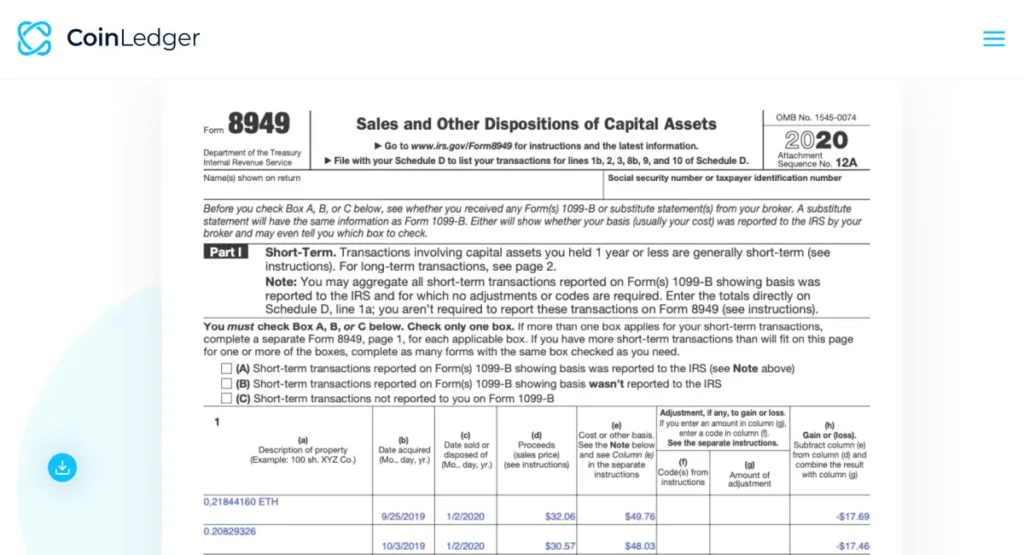

With one of the paid plans, CoinLedger helps you generate IRS Form 8949, which lists your capital gains and losses from crypto transactions or activities. This feature is a lot helpful when you have hundreds of transactions in the financial year, and you don’t want to manually sort the gains and losses for each transaction.

Not just the IRS, CoinLedger helps consumers file Crypto taxes around the globe, following the country’s specific laws and guidelines. So, you can find an option to download tax reports from your country and file your taxes accordingly. At this point in time, CoinLedger is the best and most convenient tool to offer this feature.

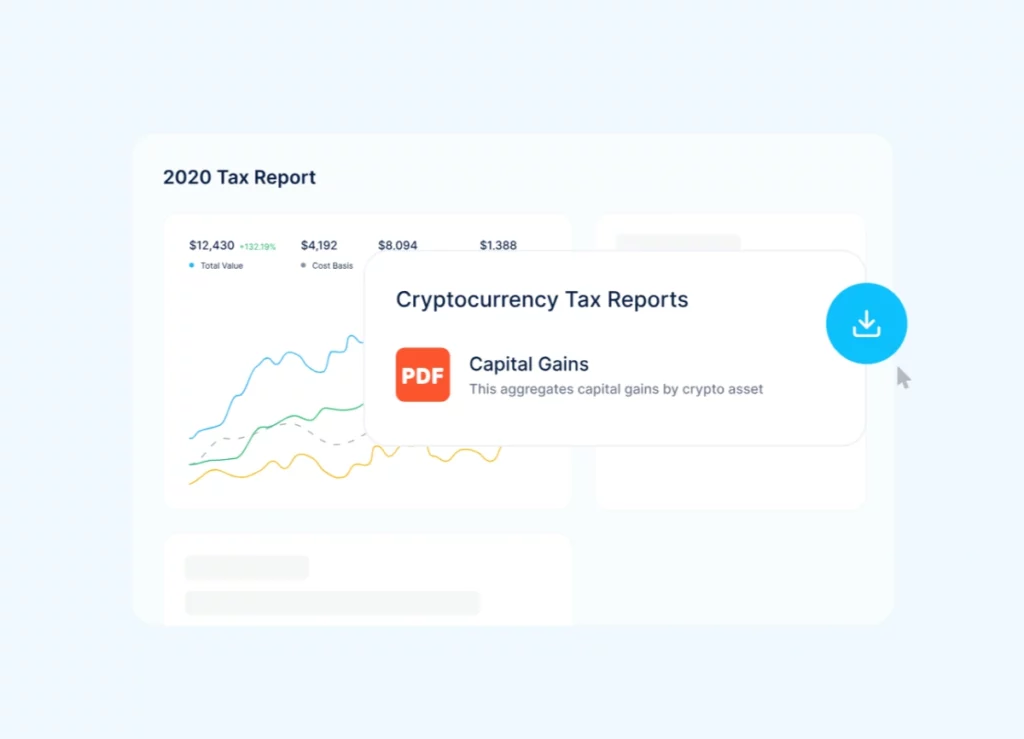

To understand your Crypto taxes, you will need two more reports: an income report and a capital gains report. As I mentioned earlier, cryptocurrencies earned as rewards, mining, staking, interests, and more are considered ordinary income, so you will have to group them under your income report. At the same time, all the other crypto transactions shall be grouped under the capital gains report. Both reports are made available to you using CoinLedger’s report feature.

You also get to generate an audit trail report, which is for personal use and includes information such as the numbers used for the calculation of your capital gains and losses, income, and more.

The tax report feature also provides you with dedicated tax loss harvesting tools, which is great for reducing your tax bill. You can learn more about tax loss harvesting from our Crypto guides.

3. Data Import

CoinLedger lets you import your data in multiple formats, such as LIFO, FIFO, HIFO, adjusted cost, and more. The tool is for your comfort and convenience, but you must be wondering how to import the data.

For this, CoinLedger offers you a few data import options. Starting with the popular one, Exchange API auto-sync. In this data import method, the tool uses a read-only API and automatically imports data from your exchange wallet. This is convenient as you don’t have to keep importing data manually, and there are a few other similar options, too.

The second data import feature is through a CSV file from your exchange. A lot of platforms let you export your exchanges in a CSV format, and you can then readily upload the file to CoinLedger. This is also a convenient method when you don’t want the tool to automatically pull out the data.

Also, if you have multiple exchanges, you can create your own CSV file and upload it to CoinLedger. This way, you have more control over what transaction data you want to file under your crypto taxes. For instance, you might not want the mining transaction data from the exchange in your crypto tax report and rather have it under the ordinary income report. Such tweaks are possible when you create your own CSV file, or you can even edit the transaction list after the upload.

The last convenient method to import your data is to use the wallet auto-sync feature. Here, you can enter your wallet’s public address, and CoinLedger will pull out all the transactions made with it.

4. Tax Software and Integrations

CoinLedger is not just tax calculation software but also tax-ready software. This means that once your tax forms are ready, you can use other tax software along with it to file your taxes readily.

There are several integration options; however, the most popular one is TurboTax software, which is widely used by consumers for tax filing. There are two TurboTax integration options: TurboTax Online and TurboTax Desktop.

So, if you are filing your taxes online, you can integrate the TurboTax Online software and club the tax reports of your cryptocurrencies with your other incomes and e-file them.

However, if you prefer filing your taxes offline, you can integrate the TurboTax Desktop and add the ready crypto tax report with your other income reports. The best part is you can find a dedicated option in TurboTax to import this crypto tax report from CoinLedger, which is a seamless great option.

There are also other tax software integrations that come along, such as TaxAct, TaxSlayer, H&R Block Desktop, and other popular options. You can find it all under the integration panel.

Now that we know most of what CoinLedger has to offer, the big question is how exactly it works. What’s the process, and how can you create your crypto tax reports without missing out on anything?

Secure Your Crypto with the Most Secure Hardware Wallets

Ledger Nano S Plus

Trezor Safe 5

How to Create Your CoinLedger Account?

Before you start doing Crypto taxes with CoinLedger, here are some simple steps on how to create your CoinLedger account.

- Visit the CoinLedger website and tap on the “Sign up” button from the top right of your screen.

- Here, you will find a couple of options to create your CoinLedger account, for instance, an email id and password, signing up with Google, and signing up with your CoinBase wallet.

- Once your account is successfully created, you can see an option to choose the country you live in, timezone, and currency. After setting up your preferences, you can tap on the “Continue” button.

- When you create your CoinLedger account, you get to add your wallets and exchanges then and there, but you can always skip this step and add them later.

- In the next step, you can find your CoinLedger dashboard and start connecting your Crypto wallets and exchanges.

How to Use CoinLedger: Importing, Calculating, and Filing Crypto Taxes

CoinLedger is designed to be a simple-to-use tool; there is an entire four-step process that guides you with importing your data, classifying it, reviewing it before generating your reports, and getting your tax reports. Honestly, I didn’t find it to be rocket science, which means anybody can use CoinLedger to create their Crypto tax reports.

But to make it more guided to you, let’s discuss each of the above four steps and understand how to use CoinLedger to file our crypto taxes.

Step 1: Importing the Data to CoinLedger Account

At this point in the review, I believe you have already created an account on CoinLedger and are ready to use it to create your tax reports. It is good to follow along with me to make the tax reports easier to create.

- Once you log in to CoinLedger, you can find the accounts tab on the left of your dashboard. This is where you can add multiple wallets and exchanges.

- Tap on the “Add Account” button from the bottom of the “Accounts” tab, which pops up a new screen with all the available options. Let’s pick the CoinBase wallet as an example and tap on it.

- On your dashboard, you can now find two options to import data for the CoinBase wallet: auto import with a read-only API and upload a CSV file. If you choose the second option, upload the CSV file, and within a few seconds, your transactions will be uploaded.

- We are picking the read-only API method to import our data; in this case, you’ll tap on the first option and then be prompted to log in to your CoinBase account. For a few wallets, NFTs, and exchanges, you also get to see other data import options, such as public wallet addresses and API connections.

- After the login is complete, your dashboard will automatically start importing all your CoinBase data. This should take some time, depending on how many transactions you have.

Here, for example, we considered importing accounts from a single wallet, but in a real-world scenario, you can have multiple wallets and exchanges, and all of them can be imported using similar steps.

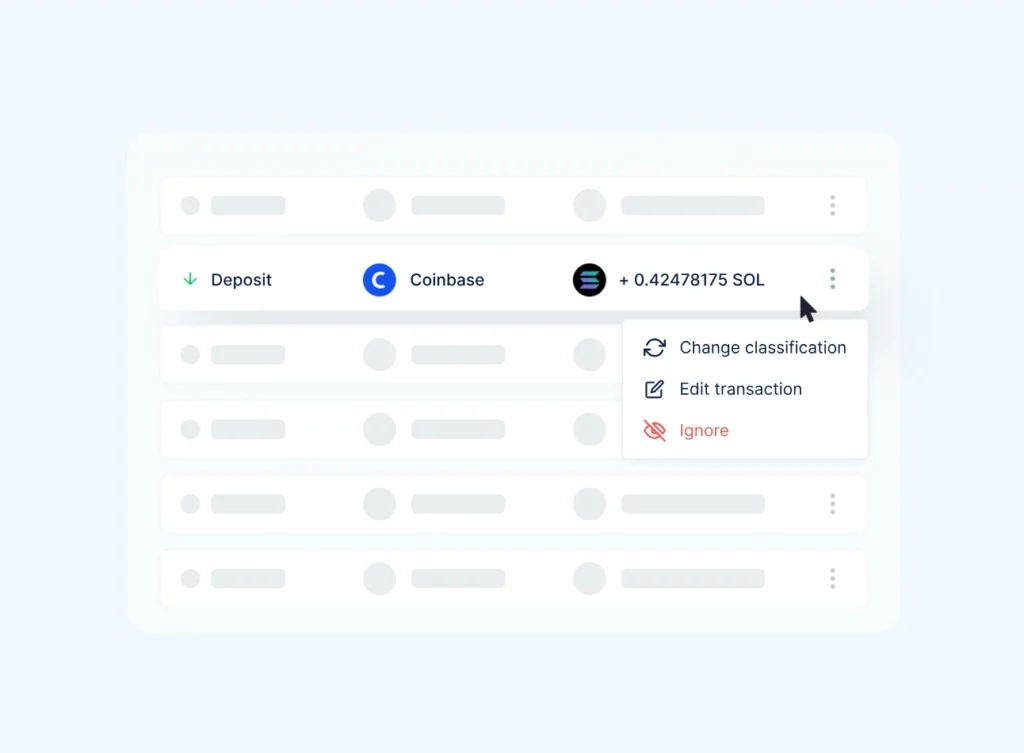

Step 2: Classifying Your Transactions

As we already know, crypto transactions are accounted for as rewards, staking, and interests, and likewise, they are treated as ordinary income. The updated version of CoinLedger, which is currently in use, automatically classifies these transactions based on your history.

However, it is important to manually classify these transactions so you don’t mess up your capital gain and loss taxes from crypto and ordinary taxes.

To classify your transactions,

- Head to the “Review” tab, and you can find all the wallets and exchanges filtered accordingly. You can also filter the transactions as per your purposes, such as accounts, assets, date range, and more.

- Once you have filtered your transaction, look for the entry that you wish to classify and then tap on it.

- On tapping the entry, you can find the classification parameters such as rewards, staking, and more. Choose the appropriate classification and save the classification.

- Repeat the steps for every such transaction so you do not mix the ordinary income with the crypto capital gains and losses.

Most of your transactions are already classified by the wallet when you import the data. However, the classification feature comes into help when you want to make manual adjustments.

Step 3: Adding Transactions and Reviewing

Step 3 is all about reviewing all your transactions before generating your tax reports. If you have dozens of transactions with a couple of wallets and exchanges, it is always best to cross-check to see if you have missed out on any important transaction.

But the API automatically syncs all the transactions from your wallets and exchanges, right? Yes, that’s true, but at times, due to technical error (which isn’t supposed to happen), there is a good chance that you miss out on crucial transactions, and generating tax reports without them can be a bigger mess. So, it is advisable that you review all your transactions and also add those that are missing.

To add a transaction,

- Tap on the “Add Transaction” button from the top right of your review screen

- Enter the details

- Tap on the “Add Transaction” to add them

After adding transactions, it is also important to classify these new entries. You can find the classifying option while adding your transaction, and if you cannot find it, you can still classify it after manually adding it.

Step 4: Preparing Your Tax Returns

We are pretty much ready for our final step, which is to generate, view, and file our crypto tax returns. To do this, we need to tap on the next tab on our screen – “Tax Reports.”

Here, you can view an entire summary of the capital gains and losses that were calculated, excluding your classifications for ordinary income. There is also information on your screen, such as the type of calculation method used and the number of transactions.

On the right of your screen, you can find an option to download your tax reports. Tap on the “IRS Forms,” and you can find a couple of tax return report options there with a generate button. The most convenient option here is to go with the IRS Form 8949 if you live in the United States.

There is also a second method to file your tax reports using CoinLedger, which is to add a tax professional to your account. When you do this, your tax professional receives an invitation email to check and download your reports and file taxes on your behalf. To add a tax professional, you can tap on “Add Tax Professional” from the top right of your screen.

One of the best things about using CoinLedger is that you already have a few popular tax software integrated into the platform. So, you can directly file your returns, be it online or offline. For this, you can either tap on the CSV file and generate a generic copy of your tax reports to add to your other taxes, or if you are using a tax software like TurboTax, you can quickly generate a specific downloadable ready file to use with the tax software.

Is CoinLedger Safe and Secure

Imagine syncing your crypto wallets, exchanges, NFTs, and other crucial information on tax software. That’s a lot of personal data that can take out all your Crypto and leave you with nothing. So, the security and safekeeping of data are crucial factors that we need to consider before using an additional service other than your wallet for your cryptocurrency.

CoinLedger does take some good security measures to ensure your data is safe. The platform never stores your personal data and uses only the read-only APIs to access the transaction history from your wallets, exchanges, and other NFTs. Also, these APIs do not access private keys, and only public addresses are used to import your data.

Additionally, all payments made on the platform, like subscriptions, are through third-party payment gateways, like Stripe, which have high-graded security. All the information on the platform, which is being processed or under process, is encrypted for security measures.

CoinLedger does look to have a strong security system in place to ensure the safekeeping of your data. Secondarily, it is best to use added security from your end, such as using two-factor authentication and a physical key for logging into the platform rather than using only text-based passwords.

Best Coin Ledger Alternatives to Consider

Koinly

Coin Panda

ZenLedger

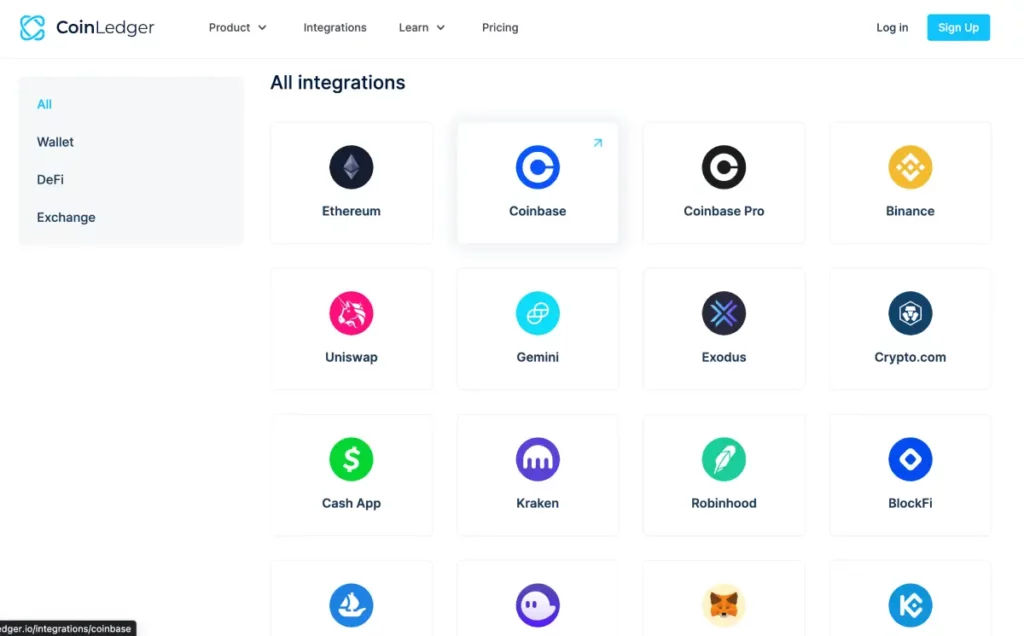

CoinLedger Integrations

Tax filing is simple and easy with CoinLedger, and one of the major reasons for this is the number of wallets, DeFi, and Exchanges the platform supports. These include both centralized and decentralized options.

The platform communicates with these integrations using a read-only API, manually connecting a public address, or uploading a CSV file to list out your transactions. Including the ones with messy imports, which are mostly convenient with CSV file uploads and ensure you do not miss out on any crypto transaction while preparing your tax reports.

Some of the popular wallets supported by CoinLedger are Exodus, MetaMask, TrustWallet, Abra, ZenGo, and a few more. At the same time, there is a huge list for DeFi and Exchanges, and these keep growing as new integrations are added.

You can check out all the integrations supported by CoinLedger to know if your exchanges or wallets are supported by the platform.

Portfolio Tracker

One of the best features of CoinLedger is a dedicated portfolio-tracking dashboard that lets you track your digital assets across all your wallets.

This is a great concept, as most of the existing portfolio trackers are not well designed to track all your gains, losses, and overall performance across wallets, centralized exchanges, and DeFi. With CoinLedger’s dedicated approach, you can monitor your performance right from your account without having to look into your wallets or exchanges each time. Now, that’s pretty fascinating.

The prominent, eye-catching features of the Portfolio Tracker are a profit and loss summary with a dedicated graph to track your performance, an asset summary to list out all your holdings and their time period, and a cost basis vs. the current market value of your assets. You can even filter them out based on the wallets, exchanges, and DeFi to know which token is performing the best for you.

The Portfolio Tracker is still under a waitlist and will soon be available to users with more added features.

Pricing and Plans: How Much Does CoinLedger Cost

Plan and pricing as per tax season, and you purchase additional transactions within the app.

Hobbyist

$49

100 transactions, core features, and data import.

$99

Most Popular

1000 transactions, core features, included tax reports, data import, and tax software integrations.

Unlimited

$199+

3000+ transactions and all features.

Is CoinLedger Worth It?

Now that we have an idea of what CoinLedger exactly does and how it works, is it really worth getting this tool? In my opinion, this is by far one of the best crypto tax tools I have come across. It has a free plan that gives you complete freedom to import your data, know your gains and losses, and even do most of the other operations, which is great. The paid plans also range between $49 to $199, with features that only add value to make your crypto taxes a lot easier to process.

It is definitely worth trying this tool if you haven’t tried it already, and there is also a 14-day money-back guarantee if you are unsatisfied with this platform, which I believe is highly unlikely. A big thumbs up.

Contact CoinLedger: Help and Support

There are not many options for help and support on CoinLedger; there are only two, to be precise. The first way is to contact the team by emailing them at help@coinledger.io, where you can explain your issue and receive an adequate solution for it. However, this is still a slow medium, and you can visit the help center (the second way) to read guides and solutions on the most common difficulties and how you can get through them.

Reviews and Ratings on CoinLedger: Here is What Other Users Have to Say

CoinLedger is by far one of the best Crypto Tax tools, and it is not just me, the only person who says it. The platform received an average rating of 4.8/5 from a total of 800+ users on Trust Pilot.

Wrapping up: CoinLedger Review | The Best Crypto Tax Software

CoinLedger is by far one of the best crypto tax software for filing your returns, and it makes the entire process easier. There are a few drawbacks, but if you look at the bigger picture, you are saving a lot of time and properly calculating your taxes as per the law with only a few clicks. I also love that there is a seamless import feature and several integrations that let you integrate almost any popular wallet, DeFi, or exchange, including NFTs, and calculate taxes on them. Once done, you can also file your taxes directly using the IRS Form 8949, which comes pre-fill based on your Crypto tax reports. The tool is easy to use and efficient, and a big thumbs up.

Did we help you out? Show us some support:

Ethereum Address

0xE7D047f1FA287f4ad298864535a62E45E789b445

Bitcoin Address

bc1q84w4qvaz5a2wne9xlf799s8we4q64a2yrttet8

Solana Address

52wokPhAncfZwGtTCHMycXGKKKAPENBw5yFTMewmpHQz

Frequently Asked Questions [FAQs]

CoinLedger supports a wide range of transactions, including trades, staking rewards, mining income, airdrops, NFT sales, DeFi activities, and blockchain-based transactions. It also handles wallet-to-wallet transfers and classifies taxable and non-taxable events.

Yes, CoinLedger is beginner-friendly with an intuitive interface and guided steps. It simplifies importing transactions, reviewing them, and generating accurate tax reports, making it easy for newcomers to file crypto taxes.

CoinLedger uses automated tools to sync transaction data and classify taxable events. It also allows manual classification and error detection to ensure all data is accurate before generating reports.

CoinLedger supports unlimited wallets and exchanges, including popular ones like Coinbase, Binance, MetaMask, and Trust Wallet. If an exchange or wallet isn’t directly supported, you can upload transaction data via CSV files.

CoinLedger uses read-only API connections, encrypts all data, and does not store private keys. Transactions are synced securely using public wallet addresses or CSV uploads, ensuring maximum data protection.

Yes, CoinLedger generates IRS Form 8949 for reporting capital gains and losses. It also provides income and audit trail reports to meet compliance standards globally.

CoinLedger integrates with popular tax filing software like TurboTax, TaxAct, and H&R Block. These integrations streamline the process of filing your crypto taxes alongside other income.

Yes, CoinLedger offers a free plan that allows users to import and review transactions, track their portfolios, and explore the platform. However, tax report generation requires a paid plan.