Managing cryptocurrency taxes is no small task. With the rise of complex crypto activities like staking, mining, DeFi, and NFT trading, staying tax-compliant has become more challenging than ever. When you combine multiple wallets, exchanges, and a high volume of transactions, the need for reliable crypto tax software becomes apparent.

Coinpanda is a crypto tax platform designed to simplify tax reporting by automating the process from transaction tracking to generating accurate tax reports. It supports over 800 exchanges, wallets, and blockchains, making it one of the most versatile tools for crypto investors. With region-specific compliance for over 85 countries, Coinpanda caters to global users who need localized tax reports that meet jurisdictional requirements.

Whether you’re a casual investor, a professional trader, or someone exploring DeFi and NFTs, Coinpanda provides an intuitive interface, automated features, and robust error-checking tools to make tax filing seamless. In this review, we’ll take an in-depth look at what Coinpanda has to offer, how to get started, and whether it’s the right tool for your crypto tax needs.

Coinpanda Overview

| Feature | Details |

|---|---|

| Ease of Use | Simple and intuitive interface for all levels of users. |

| Integrations | Over 800 platforms, including exchanges, wallets, and blockchains. |

| Accuracy | Automatic error detection ensures precise calculations. |

| Customizability | Supports FIFO, LIFO, and HIFO accounting methods. |

| Global Compliance | Tax reports compatible with 85+ countries and major tax authorities like IRS, HMRC, and ATO. |

| DeFi and NFT Support | Handles staking, yield farming, and NFT trading with ease. |

| Security | GDPR-compliant with encrypted data and read-only API connections. |

| Pricing | Affordable plans with a free trial to explore features. |

| Portfolio Tracking | Real-time insights into your holdings and performance. |

| Customer Support | Comprehensive help center, email support, and active community forums. |

Overall Rating:

Coinpanda is a versatile and reliable crypto tax software, excelling in ease of use, global compliance, and support for advanced crypto activities like DeFi and NFT trading. With integrations across over 800 platforms and automated features that save time and reduce errors, it’s an excellent choice for both beginners and seasoned investors. Its accurate tax reporting, robust error detection, and flexible pricing plans make it a valuable tool for simplifying complex crypto tax processes. If you’re seeking an efficient, user-friendly solution for crypto tax management, Coinpanda is a top contender.

Pros: How Good is Coinpanda?

Cons: Key Improvements

$15 Discount when you register using our link.

What is Coinpanda?

Coinpanda is a comprehensive cryptocurrency tax software designed to simplify the complexities of crypto tax reporting. Whether you’re trading on multiple exchanges, earning staking rewards, or exploring NFTs, Coinpanda ensures that your transactions are accurately tracked, categorized, and reported. Its support for over 800 integrations makes it one of the most versatile platforms available.

Coinpanda automates the process of calculating capital gains, losses, and income while generating tax reports tailored to local regulations. Users can choose accounting methods like FIFO, LIFO, and HIFO, allowing for optimized tax calculations. Its error-detection tool further ensures that discrepancies are flagged and corrected before reports are generated.

The platform’s strength lies in its global compliance, supporting tax jurisdictions across 85+ countries, including the IRS (US), HMRC (UK), and ATO (Australia). Additionally, Coinpanda caters to advanced crypto activities like DeFi staking and NFT trading, ensuring that even the most complex transactions are handled seamlessly.

Whether you’re new to crypto or an experienced trader, Coinpanda’s intuitive interface and automated features make it a reliable choice for staying tax-compliant.

Secure Your Crypto with the Most Secure Hardware Wallets

Ledger Nano S Plus

Trezor Safe 5

How to Create a Coinpanda Account

Creating a Coinpanda account is a straightforward process, and it took us less than a minute to set up our account and start using the tool. In this review guide, we will make the process a lot easier for you with detailed steps.

How to create a Coinpanda account,

- Visit the Coinpanda website and click on the “Try for Free” button at the top-right of the homepage.

- A new webpage with the signup options will be presented on your screen. Here, you can either sign up using your email address and create a password or sign up using your Google account.

- Once done, verify your email by using the confirmation link sent to you on your registered email address. If you cannot find it, look for the spam folder.

- Log in to the dashboard, and you can start using the tool right away.

$15 Discount when you register using our link.

Setting Up Your Coinpanda Account

Using Coinpanda is a lot easy, and the best thing is you can get started for free. The free plan offers portfolio tracking, connecting wallets, and viewing limited transactions, which is nice, but to make it efficient, you might want to consider at least the lowest-paid plan: $79/Year. There are also other plans and pricing options, which we will discuss in a dedicated section of our review, but for now, let’s go with the free plan; you can always upgrade later.

Once you are in, let’s set up our wallet and exchanges.

Connecting Wallets and Exchanges

When you connect your wallets and exchanges with Coinpanda, importing transactions and managing your data becomes a lot easier. In fact, this step helps you save hours of manually entering each transaction with all other details. Here, you will only require the “Read-only” API access to your crypto wallet or exchange, and the tool will automatically import all the data for you.

Don’t worry; since the access is “Read-Only,” your crypto coins are safe. But where can you find this API? Usually, it is available on your profile or account settings, and it depends on what platform you are using.

Here is a simple walkthrough on how you can connect your wallet and exchange to Coinpanda,

- Once you log in to your Coinpanda account, head to the Wallets section on your Coinpada dashboard.

- Tap on the “Add Wallet or Exchange” and look for the particular wallet or exchange you use using the search bar. Popular options like Coinbase are already available on the screen for your convenience.

- Choose how and when you wish to import your data. In our case, we will use the API method. You can also skip importing data for now using the “Import Transactions Later” option.

- Now, enter the API key of the wallet or exchange you use, and remember to paste only a read-only API key and not any other access.

- If the wallet/exchange does not support API, you can export your transaction as a CSV file and upload it on Coinpanda.

- After syncing, you can check and see that all transactions appear accurately.

Review and Categorize Transactions

This is one of the crucial steps. Once you import your transactions, it becomes a lot more important to review these transactions and look out for incorrect, flagged, or missing entries. This review needs manual attention as it is the most important part of the crypto tax filing process. If you miss out on a few entries, you may have an incorrect audit, which leads to penalties or confusion later.

Here are a few steps we recommend,

- Head to the Transactions section to see a list of all imported data.

- Go through each transaction and look for details, such as if they are correctly labeled as trades, rewards, or income, and other details.

- If there are flagged entries for missing or duplicate entries, resolve them; the tool lets you edit the imported data.

Generate Tax Reports

We have basically finished most of the process, and now all we need to do is a few button clicks to generate our tax report. The process is so seamless that it takes so little time to generate reports that are ready to be filed using filing tools such as TurboTax or TaxAct.

But before we generate our crypto tax reports, there are a few tweaks here and there; let’s quickly go through them.

- On your Coinpanda dashboard, you can find the “Tax Reports” section; tap on it.

- Choose the relevant tax year for which you wish to generate the report.

- Now, you get to pick what accounting method you use for managing your accounts. For instance, FIFO, LIFO, or HIFO, and picking the right one helps you maintain a consistent report and keeps you away from any confusion.

- The last thing to do is select the type of jurisdiction and currency for tax compliance. This helps the tool to prepare tax reports that are compliant with your region. For instance, IRS in the United States.

- Now, tap on generate, and your tax reports are ready in a breeze. You can also export these reports in PDF and CSV formats or directly use tools like TurboTax or TaxAct to file your tax report.

Core Features | Coinpanda Crypto Tax Software

Coinpanda offers various features, but at the heart of this tool are five core features that make it one of the most reliable and reputed crypto tax software. Features such as automated portfolio tracking, accurate tax calculations, error detection, DeFi and NFT support, and unlimited integrations with various wallets and exchanges. These features make Coinpanda one of the most reliable tools in its lineup.

Let’s take a brief look at each of these features:

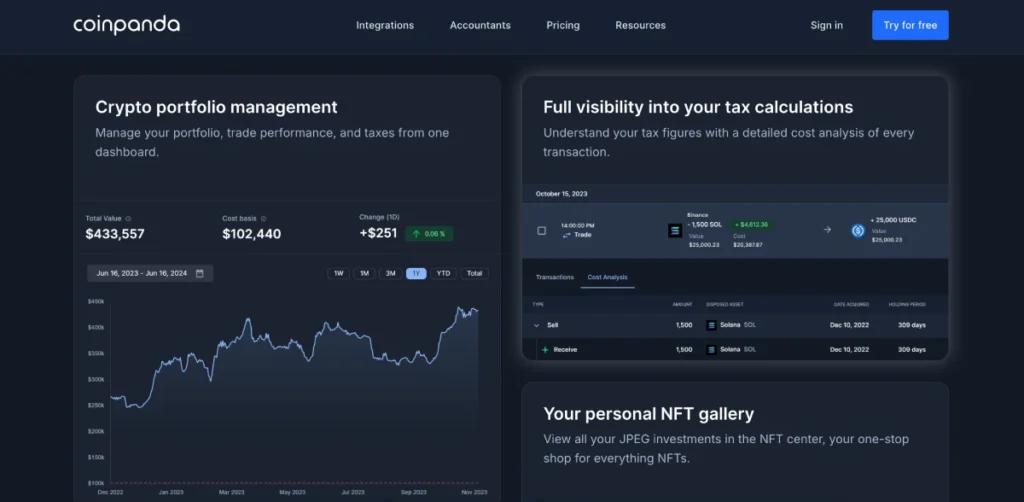

1. Automated Portfolio Tracking

Coinpanda simplifies portfolio management by automatically consolidating data from over 800 exchanges, wallets, and blockchains into a single dashboard. Once you connect your wallets or exchanges, the platform retrieves your transaction history and organizes it into clear, actionable insights. This automation saves users from the tedious task of manual data entry, reducing errors and ensuring accuracy.

With real-time tracking, Coinpanda provides an overview of your portfolio’s performance, showing profits, losses, and asset holdings. This feature is invaluable for users managing multiple accounts or dealing with a high volume of transactions. For example, whether you’ve traded Bitcoin on Binance, earned staking rewards on Ethereum, or purchased NFTs via OpenSea, Coinpanda consolidates all this information seamlessly.

In addition to transaction tracking, Coinpanda categorizes events into taxable and non-taxable activities, simplifying the process of generating accurate tax reports. The dashboard’s intuitive design ensures even beginners can navigate their portfolio with ease, while advanced users benefit from detailed metrics and filters to analyze their transactions.

2. Accurate Tax Calculations

Accurate tax calculations are at the heart of Coinpanda’s functionality. The platform automates complex calculations for activities like capital gains, staking rewards, mining income, and NFT transactions. Users can select from accounting methods like FIFO (First In, First Out), LIFO (Last In, First Out), or HIFO (Highest In, First Out), allowing for tax optimization based on individual strategies or regional regulations.

Coinpanda tailors its tax engine to comply with the laws of over 85 countries, ensuring that your reports meet local requirements. This global compatibility is especially useful for investors operating across multiple jurisdictions. For example, whether you’re filing with the IRS in the US, HMRC in the UK, or the ATO in Australia, Coinpanda ensures compliance.

Additionally, the platform considers unique scenarios like wash sales, airdrops, and liquidity pool rewards, which are often overlooked by traditional tax tools. Its ability to calculate short-term and long-term capital gains with precision reduces the risk of errors, ensuring you’re always prepared for tax season. Coinpanda’s accuracy in handling even the most complex crypto activities gives users confidence in their filings.

3. Error Detection

Coinpanda’s error detection feature ensures that no transaction is overlooked or miscategorized. This is particularly important for users dealing with a high volume of transactions across multiple platforms. The platform automatically identifies issues such as missing data, duplicate entries, or incomplete transaction histories.

For instance, if an exchange fails to log a withdrawal or deposit, Coinpanda flags the discrepancy for your review. This proactive approach saves users time and prevents inaccuracies from propagating into their tax reports. Additionally, Coinpanda highlights potential mismatches in token balances, ensuring that all assets are accounted for.

The error detection tool is especially valuable for users involved in complex crypto activities like staking, liquidity farming, or NFT trading, where transactions can become difficult to track. By providing detailed explanations and suggestions for resolving errors, Coinpanda empowers users to take corrective actions quickly. This feature minimizes the risk of audits or penalties, giving users peace of mind when filing their taxes.

4. DeFi and NFT Support

Coinpanda excels at handling advanced crypto activities like DeFi staking, yield farming, and NFT trading. These activities often involve intricate transactions that are challenging to track manually. Coinpanda simplifies this by automatically categorizing taxable and non-taxable events, ensuring compliance with tax regulations.

For DeFi users, the platform tracks staking rewards, liquidity pool interactions, and token swaps across popular platforms like Uniswap, PancakeSwap, and SushiSwap. For example, if you’re earning rewards from a liquidity pool or swapping tokens on a decentralized exchange, Coinpanda captures the details and includes them in your tax report.

NFT traders also benefit from Coinpanda’s support for marketplaces like OpenSea and Rarible. The platform logs NFT purchases, sales, and transfers, ensuring that gains or losses are calculated accurately. This feature is crucial for modern investors engaging in these emerging sectors, where taxable events can easily be overlooked.

By providing specialized support for DeFi and NFTs, Coinpanda ensures that users can confidently explore these innovative technologies without worrying about the complexities of tax reporting.

$15 Discount when you register using our link.

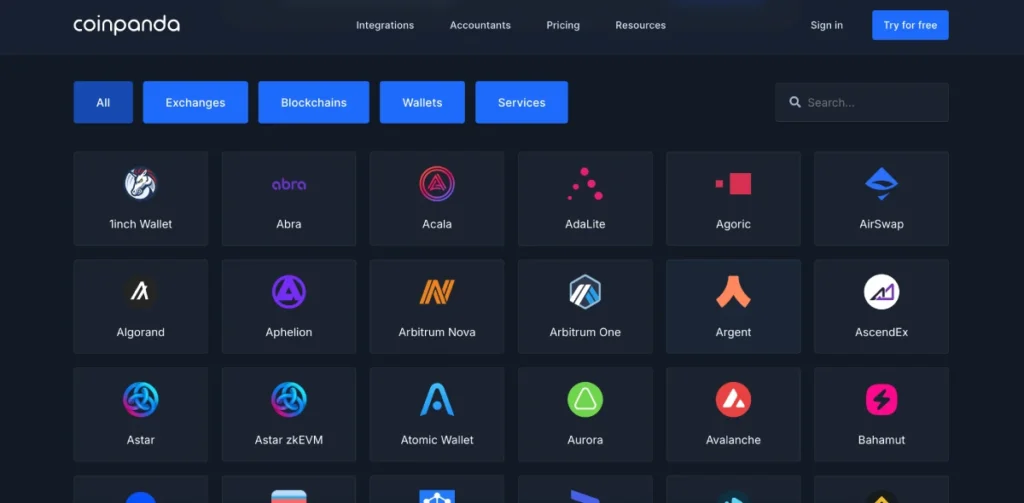

Coinpanda Integrations

Coinpanda offers support for more than 2450+ wallets and exchanges alongside DeFi, NFTs and blockchain, which makes Coinpanda a preferable tool. Not only popular, here, you can find even lesser-known options. Besides, if you cannot find your preferred wallet or exchange, you can use the manual import option to import all your transactions from various sources and consolidate them on your Coinpanda dashboard. It also offers features like portfolio tracking, which also lets you keep an eye on the stats while you are generating tax reports.

Here are some details,

1. Wallet Integrations

Coinpanda supports a wide range of wallets, including hardware wallets like Ledger and Trezor and hot wallets like MetaMask, Trust Wallet, and Exodus. These integrations allow users to automatically sync their wallet transactions, saving time and reducing the risk of errors. By connecting wallet addresses directly to the platform, Coinpanda retrieves transaction histories for deposits, withdrawals, and token transfers.

This feature is particularly beneficial for users managing multiple wallets. For example, if you use Ledger for cold storage and MetaMask for active DeFi transactions, Coinpanda consolidates data from both wallets into a unified dashboard. It also supports less common wallets, ensuring users with diverse portfolios can track all their activities seamlessly.

Another advantage is its ability to capture on-chain transactions. For example, if you’re earning staking rewards directly into a wallet or participating in token swaps on decentralized platforms, these activities are accurately logged. Coinpanda’s wallet integrations eliminate the need for manual tracking, providing a comprehensive view of your crypto holdings and activities.

With its robust wallet support, Coinpanda ensures that all crypto transactions are accounted for, giving users confidence in their tax reporting process.

2. Exchange Integrations

Coinpanda integrates with over 500 exchanges, making it one of the most versatile crypto tax platforms. Popular exchanges like Binance, Coinbase, Kraken, Bitfinex, and KuCoin are fully supported through API connections. These integrations enable real-time syncing of transactions, including trades, deposits, and withdrawals.

For exchanges without API support, Coinpanda allows users to upload CSV files containing their transaction history. This flexibility ensures that users can track activities from both major platforms and niche exchanges. For instance, if you’re actively trading on Binance but also experimenting with regional platforms, Coinpanda ensures all your transactions are consolidated into a single dashboard.

The platform is particularly adept at handling advanced trading activities such as margin trading and futures contracts, ensuring that all taxable events are accurately categorized. Users can also reconcile discrepancies easily using the platform’s error detection feature, which flags missing or duplicate transactions.

By supporting such a broad range of exchanges and transaction types, Coinpanda simplifies the task of consolidating data from multiple platforms. Whether you’re a beginner or a professional trader, the comprehensive exchange integrations ensure that no transaction is overlooked.

3. Blockchain Support

Coinpanda’s blockchain support is one of its standout features, enabling users to track activities across major networks like Bitcoin, Ethereum, Solana, Avalanche, and Polygon. By directly integrating with these blockchains, Coinpanda captures on-chain transactions such as token transfers, staking rewards, and smart contract interactions.

This is particularly valuable for users engaging in decentralized finance (DeFi), where many transactions occur directly on the blockchain. For instance, if you’ve participated in an Ethereum staking pool or bridged assets across blockchains like Polygon and Solana, Coinpanda logs each transaction accurately. The platform ensures that all taxable events—whether related to staking, liquidity pools, or yield farming—are categorized correctly.

Coinpanda also supports smaller or emerging blockchains, catering to users with diverse portfolios. This comprehensive coverage ensures that no activity is missed, providing a detailed and accurate tax report.

4. DeFi and NFT Platforms

Coinpanda’s support for DeFi and NFT platforms sets it apart from many competitors. For DeFi, the platform integrates with popular protocols like Uniswap, PancakeSwap, and SushiSwap, tracking complex activities such as staking rewards, token swaps, and liquidity pool interactions. These transactions are automatically categorized as taxable or non-taxable events, ensuring compliance with tax regulations.

For NFT enthusiasts, Coinpanda supports major marketplaces like OpenSea and Rarible, logging all transactions related to NFT purchases, sales, and transfers. For example, if you’ve bought an NFT on OpenSea and later sold it for a profit, Coinpanda calculates the capital gain and includes it in your tax report.

These integrations are particularly valuable for users exploring decentralized ecosystems, where transaction tracking can become overwhelming. By capturing every detail, from staking rewards to NFT trades, Coinpanda ensures accurate reporting for even the most advanced crypto activities. Its ability to handle these unique scenarios makes it a go-to solution for DeFi and NFT users.

Is Coinpanda Worth It?

Coinpanda stands out as a reliable and efficient tool for managing cryptocurrency taxes, catering to users across varying levels of crypto engagement. Its extensive integrations, user-friendly interface, and robust error detection make it a compelling choice for both beginners and seasoned investors.

One of the key reasons Coinpanda is worth considering is its ability to automate time-consuming processes. From importing transaction histories to categorizing taxable events, Coinpanda streamlines the entire workflow. This automation not only saves hours of manual effort but also minimizes the risk of human errors, ensuring accurate tax reports.

For global users, Coinpanda’s compliance with tax regulations in over 85 countries provides unmatched flexibility. It generates reports tailored to the requirements of major tax authorities like the IRS (US), HMRC (UK), and ATO (Australia), ensuring users stay compliant regardless of their jurisdiction. Its support for accounting methods like FIFO, LIFO, and HIFO further enhances its adaptability to diverse tax strategies.

Coinpanda also excels in handling complex crypto activities like DeFi staking and NFT trading, which are often neglected by other tax software. This capability ensures that even advanced users can rely on it for comprehensive tax reporting. Moreover, its flexible pricing plans make it accessible to everyone, from casual investors to professional traders managing thousands of transactions.

$15 Discount when you register using our link.

Pricing and Plans: How Much Does Coinpanda Cost?

Coinpanda offers a variety of pricing plans tailored to different user needs. From a free trial for portfolio tracking to advanced options for high-volume traders, its pricing structure is both flexible and competitive.

Hodler

$79/Yr

100 transactions,

Tax reports for all years,

Portfolio tracking, and

Unlimited integrations

$149/Yr

Most Popular

1000 transactions,

Everything from the Hodler Plan +

Tips and ledger analysis,

Smart contract interactions, and

Automated on-chain transactions

Pro

$289/Yr

3000 transactions, Everything in the Trader Plan + Priority request assistance

Satoshi

$499/Yr

20,000+ transactions, Everything in the Pro Plan + Custom imports

The free plan is ideal for beginners exploring Coinpanda’s features. It includes basic portfolio tracking and transaction syncing but does not support tax report generation. This makes it a great starting point for users who want to test the platform without committing to a paid plan.

This plan supports up to 100 transactions, making it suitable for casual investors with minimal trading activity. It includes unlimited integrations, portfolio tracking, and tax reports for all years.

Designed for active traders, this plan covers up to 1,000 transactions. It offers all the features of the Hodler Plan alongside tips and ledger analysis, smart contract interactions, and automated on-chain transactions.

Tailored for professional traders or investors managing high transaction volumes, the Pro Plan supports up to 3,000 transactions. Alongside all the features of the Trader Plan, it offers priority request assistance to help you with quick needs.

Made for professional crypto traders with high-volume trading, the Satoshi Plan offers 20,000 transactions, everything with the Pro Plan, and custom imports. Just the ideal plan for the high volume traders.

For users with over 20,000 transactions, Coinpanda offers custom pricing plans. These plans are designed to accommodate unique needs, such as managing large-scale portfolios or supporting business clients.

Best Coinpanda Alternatives to Consider

Koinly

Coin Ledger

ZenLedger

Contact Coinpanda: Help and Support

Coinpanda provides a robust support system to ensure users can resolve their queries and navigate the platform with ease. Whether you’re a beginner or a seasoned trader, its multiple support channels cater to all levels of expertise, making it a dependable choice for crypto tax reporting.

Help Center

The Coinpanda Help Center is a comprehensive resource hub that includes detailed articles, guides, and FAQs. These resources cover everything from getting started with the platform to troubleshooting integration issues. The content is well-structured and regularly updated, ensuring users have access to accurate information.

For example, if you’re unsure about how to upload a CSV file or generate a tax report, you’ll likely find step-by-step instructions in the Help Center. The search functionality also makes it easy to locate specific topics, saving users time.

Email Support

For personalized assistance, Coinpanda offers responsive email support. Users can submit queries through the platform, and the support team typically responds within 24 hours. Paid plan users often receive faster response times, ensuring urgent issues are addressed promptly.

Email support is particularly useful for resolving complex issues, such as discrepancies in transaction imports or advanced tax report customization.

Community Forums

Coinpanda hosts an active community forum where users can share insights, ask questions, and discuss experiences. This peer-to-peer support channel is a valuable resource for learning best practices and staying updated on platform developments.

Priority Support for Pro Users

Users subscribed to the Pro Plan or custom plans enjoy priority support. This includes faster response times and access to more detailed assistance for advanced features, making it ideal for professionals and high-volume traders.

Coinpanda’s multi-channel support system reflects its commitment to user satisfaction. Whether you’re troubleshooting an issue or seeking advice on tax optimization, the platform ensures you’re never left without guidance.

Conclusion: Is Coinpanda the Best Crypto Tax Software?

Coinpanda is a powerful and reliable tool for simplifying crypto tax reporting. Its ability to automate key processes, such as importing transactions, categorizing events, and generating tax reports, makes it a time-saving solution for users of all experience levels. The platform’s support for over 800 integrations and compliance with 85+ jurisdictions ensures comprehensive coverage for global users.

What sets Coinpanda apart is its focus on handling advanced crypto activities like DeFi and NFT transactions. These capabilities make it an ideal choice for modern investors exploring decentralized finance and blockchain technologies. Additionally, its error detection feature ensures accuracy, reducing the risk of discrepancies in tax reports.

In summary, Coinpanda combines ease of use, automation, and accuracy, making it a top contender for the best crypto tax software. If you’re looking for a dependable, user-friendly solution to manage your crypto taxes, Coinpanda is undoubtedly worth considering.

$15 Discount when you register using our link.

Did we help you out? Show us some support:

Ethereum Address

0xE7D047f1FA287f4ad298864535a62E45E789b445

Bitcoin Address

bc1q84w4qvaz5a2wne9xlf799s8we4q64a2yrttet8

Solana Address

52wokPhAncfZwGtTCHMycXGKKKAPENBw5yFTMewmpHQz

FAQs About Coinpanda Crypto Tax Software

Coinpanda supports a wide range of transaction types, including trades, staking rewards, mining income, liquidity pool transactions, airdrops, and NFT sales. It also handles token swaps and transfers between wallets, ensuring that all activities are accurately tracked and categorized for tax reporting.

Yes, Coinpanda is designed with beginners in mind. Its intuitive interface and detailed guides make it easy for new users to import transactions, categorize events, and generate tax reports. The platform’s automated features reduce the complexity of managing crypto taxes.

Coinpanda integrates with over 800 platforms, including major exchanges like Binance, Coinbase, Kraken, and Bitfinex, as well as wallets like Ledger, MetaMask, and Trezor. For unsupported platforms, users can manually upload CSV files.

Coinpanda prioritizes security with advanced encryption protocols, GDPR compliance, and read-only API connections. These measures ensure that your sensitive data remains protected while using the platform.

Yes, Coinpanda is well-suited for advanced crypto activities. It supports staking rewards, yield farming, and liquidity pool transactions from platforms like Uniswap and PancakeSwap. Additionally, it tracks NFT trades and sales from marketplaces like OpenSea and Rarible.

If you exceed your transaction limit, you can easily upgrade to a higher-tier plan. Coinpanda’s flexible pricing structure ensures that users can scale their plans as their portfolios grow.

Absolutely. Coinpanda generates tax reports that comply with regulations in over 85 countries. These reports are compatible with major tax authorities like the IRS (US), HMRC (UK), and ATO (Australia), as well as tax software like TurboTax and Xero.

Yes, Coinpanda provides comprehensive customer support through its Help Center, email support, and active community forums. Pro Plan users also receive priority support for faster resolution of issues.